I have a dream that one day on the red hills of Georgia, the sons of former slaves and the sons of former slave owners will be able to sit together at the table of brotherhood.

I have a dream that one day on the red hills of Georgia, the sons of former slaves and the sons of former slave owners will be able to sit together at the table of brotherhood.

Oh how not to agree with Paul Krugman when he notices that explaining the euro crisis because of the differences in economic performance across states of the Union is a weak explanation at best. Greece and Portugal? Fine, what about Mississippi and Alabama? Or Otter Pradesh and Orissa in India?

Yes, Krugman is right, we the Europeans are no nation. No, Krugman is wrong, we dont need a Secession war to become one.

But what does it mean exactly? To be a nation?

I think of another couple of monetary unions, closer to home. The Italian and the German ones. The first one almost collapsed recently when the Northern League was pushing many of its supporters to say “enough with the South”. The second one never had one moment of lack of credibility given the incredible and convinced economic support the West gave to the East.

A Nation is a contract. A union among diverse communities to become more powerful and to better expand or protect one’s values. To be stable, not to be threatened within, while democratic it must: a) tolerate differences and b) provide equal treatment. The first requires politics, the second one economics. Both of them, needed politics and needed economics, share one necessity: solidarity. If one or both of these are denied, through the denial of solidarity, the Union collapses.

So it goes for the euro area. Market spreads are high not so much because Greece lacks productivity, not so much because Greek politicians are heavy spenders, but because both of these two features seem to be little tolerated by other member countries. Markets know that intolerance is at the root of the break-up of a Union.

Therefore here are your spreads, explained.

Which brings about the interesting issue of the unintended and paradoxical fact that currently in the euro area the most important supporter of tolerance, solidarity and diversity is the Market. That’s right, financial markets. They are the ones that have most to gain from the right shift in the name of values toward a truly United Europe. They are the ones that might push for the right solution. Unbelievable.

Therefore here is the explanation of how to save the euro, obvious.

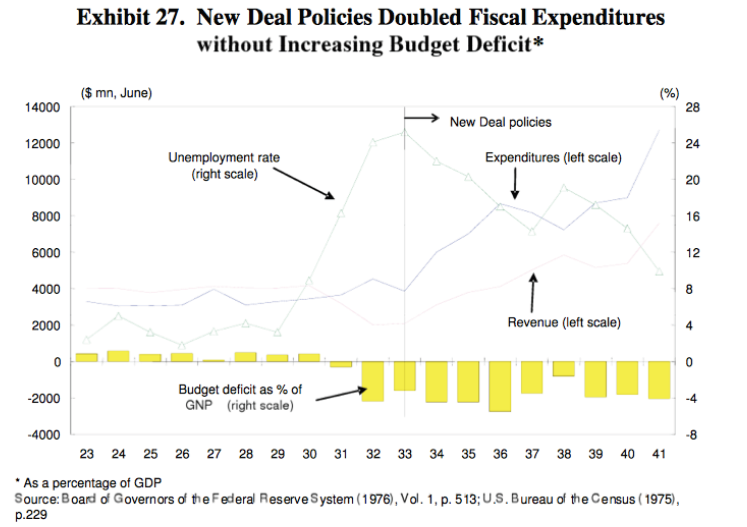

Transfers from the rich states to the poor states are the quintessential need of a monetary union. I agree with Krugman. Forget about European banking supervision, forget about centralizing fiscal policy. Maybe ECB direct purchases of bonds and a Greek bail-out, as they both embed a certain amount of tolerance and understanding for those who have sinned and will sin again, will provide a respite. But then you will need – in addition – to annually be able to transfer from Germany to Greece large chunks of money like Massachusetts does with Mississippi. Are we ready for this? Are we ready for saying yes the Greek, the Italians, they are bad spenders and they are incapable of doing reforms as well as other do but we will trasnfer money to them nonetheless, from here to eternity for the sake of the greater Europe we want to build? Like the West Germans have promised to the Easterners?

No, Prof. Krugman, no war is needed.

I have a dream. I know, I know. But it is my dream and you can’t take that away from me.