Take two unrelated events, one in Lindau, Germany, the other in Jackson Hole, United States, taking place in the same days.

You have the chance to listen to a Nobel Prize winner and the Chairman of a key Central Bank.

The former, Chris Sims, argues that when deflation-risk arises and monetary policy is powerless because interest rates are alredy minimal at the zero bound, deflation and recession materialize in those countries where fiscal policy also is perceived by consumers and firms never to be able to generate for extended periods deficits and debt, supporting internal demand.

Europe fits perfectly this description: an area where the Fiscal Compact – Europe’s constitutional rule against debt accumulation – forbids deficits to mount, even in a recession, does not allow optimistic beliefs for the future to arise. Investment and consumption are postponed, a recession arises, reinforcing deflation.

The Fiscal Compact was formally announced to markets, consumers and frms on March 15, 2011.

http://www.consilium.europa.eu/uedocs/cms_data/docs/pressdata/en/ecofin/119888.pdf

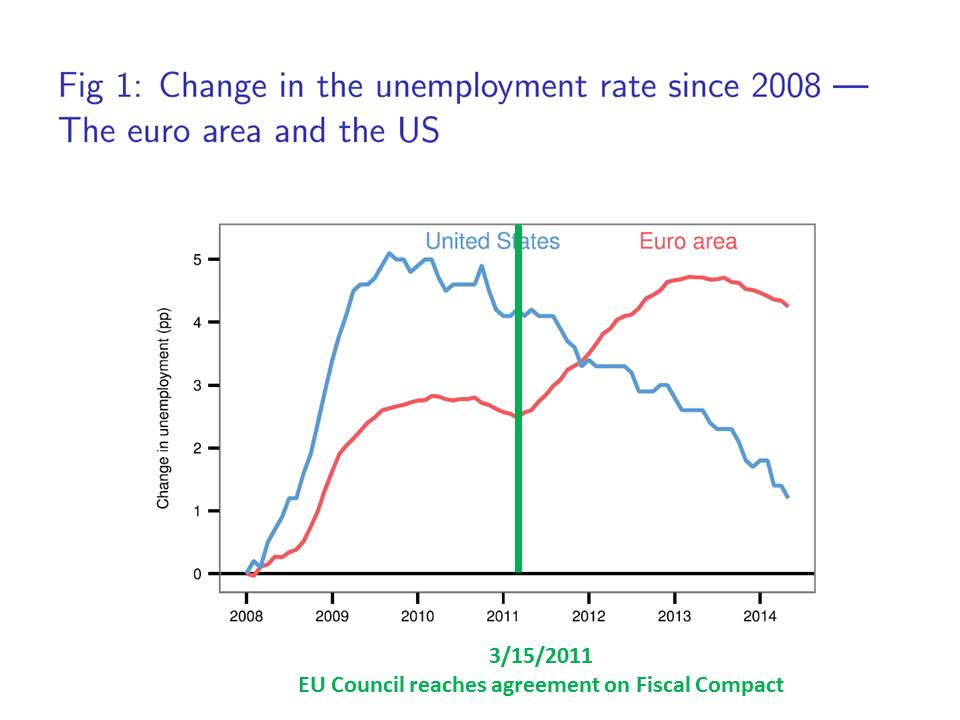

Now, look at the following slide put forward by Mario Draghi, European Central Bank President, at the Federal Reserve of Kansas meeting in Jackson Hole. It shows euro area and US unemplyment dynamics since the Lehman crisis.

What do you notice?

Yes, you got it. As Mario Draghi himself remarked, unemployment followed similar dynamics in both areas in the first years after the crisis, decoupling afterwards, with US unemployment collapsing and the euro area’s one rising.

http://www.ecb.europa.eu/press/key/date/2014/html/sp140822.en.html

And guess when the decoupling started? Yes, you got it, exactly when the Fiscal Compact was announced. In that same period, that is, when private sector actors in Europe lost the hope that internal demand would be sustained in the years to come by, what Prof. Sims aptly called, ”the kind of fiscal expansionary commitment” that was and is still needed to end the recession and the deflation simultaneously in Europe.

And guess when the decoupling started? Yes, you got it, exactly when the Fiscal Compact was announced. In that same period, that is, when private sector actors in Europe lost the hope that internal demand would be sustained in the years to come by, what Prof. Sims aptly called, ”the kind of fiscal expansionary commitment” that was and is still needed to end the recession and the deflation simultaneously in Europe.

Frankly speaking, why would you want to invest and spend in a geographic area where, in the face of extremely negative shocks, you are told that the public sector will never intervene to lighten the burden with lower taxes and greater public spending?

I know, many other factors might explain the decoupling. But it is hard to resist the temptation to share with you this one also thanks to the brilliant explanations of Prof. Sims and the stylized facts proposed by President Draghi.

24/08/2014 @ 15:51

Gustavo:

Excellent, insightful presentation -Great chart on the change in the unemployment rate-The euro area and the US.

The Economist,August 23,2014 published an article to push the ECB along.Be Bold, Mario-The European Central should learn from the success of unconvential policies in America and Britain.

Good luck, R. WAlker