Sorry to my foreign readers for being so lazy about writing in English. These are hectic times in Italy and I have unlawfully neglected you.

Sorry to my foreign readers for being so lazy about writing in English. These are hectic times in Italy and I have unlawfully neglected you.

Just thought I would let you know that whoever says that the difference between this side and that side of the Atlantic is our central banks – the Fed and the ECB - is from now on proven plain wrong. We are used to say that the ECB is a temple of conservative anti-inflationary hawks while the Fed cares about employment and growth.There is a new ECB working paper here to disprove it.

Because this ECB working paper was written jointly by 2 ECB researchers and one from the US Federal Reserve System, even though on the first page you can read a disclaimer that takes away part of the fun (This Working Paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB, the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System), it gives joy to see that everyone agrees: expansionary fiscal policy works like wonder to reduce the impact of a recession.

It does. We knew that. But we thought in Frankfurt they didn’t.

Let’s dutifully quote their work (which also appeared in the American Economic Review Papers and Proceedings):

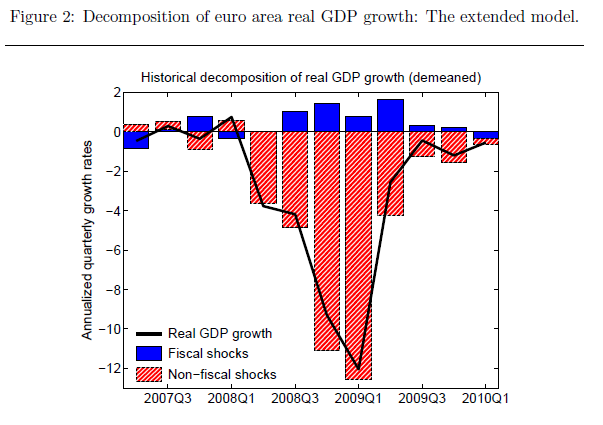

“How much did fiscal policy contribute to euro area real GDP growth during the Great Recession? We estimate that discretionary fiscal measures have increased annualized quarterly real GDP growth during the crisis by up to 1.6 percentage points. We obtain our result by using an extended version of the European Central Bank’s New Area-Wide Model with a rich specification of the fiscal sector.”

Yes, that’s right. Or else look at the graph.

You see, the blue bars are the good guys: more public spending and/or less taxes chosen explicitly by governments (discretionary, that is). They fight the bad guys, the red bars: all the recessions’ shocks that hit Europe bewteen 2007 and 2010. Thanks to the good blue guys, the economy evolved (the black line) better than what it would have done without it (the red bars).

You see, the blue bars are the good guys: more public spending and/or less taxes chosen explicitly by governments (discretionary, that is). They fight the bad guys, the red bars: all the recessions’ shocks that hit Europe bewteen 2007 and 2010. Thanks to the good blue guys, the economy evolved (the black line) better than what it would have done without it (the red bars).

Who were the most important blue troopers? Government spending on consumption and investment, John Wayne and Rock Hudson, always them, the Undefeated. They explain most of the compensation to the negative shocks.

Now there is only thing left to do. Have Mario Draghi, the ECB Governor, read that paper published in his Bank. He might finally be convinced of who are the bad guys that want the euro destroyed and side with John Wayne and Rock Hudson, allowing stupid austerity to be banned.