So the big problem seems to be that (European?) countries that are in the midst of the worse recession ever occurred after WWII adopt restrictive fiscal policies instead of expansive ones. Big mistake. We economists say these wrong policies are pro cyclical (budgets and GDP move in the same way: public expenditure go down, taxes go up and budget deficits down when the cycle goes down) while they should be counter-cyclical (budgets and GDP move in the opposite direction: public expenditure goes up, taxes go down and budget deficits up when the cycle goes down) to support the economy in bad times.

Why do governments adopt (wrongly) pro-cyclical fiscal policies and worsen economic cycles when these are already weak?

Three economists, Jeffrey A. Frankel, Carlos A. Végh and Guillermo Vuletin, just came out with a new NBER Working Paper that sheds an interesting twist on this issue. They argue that governments with good institutions learn or find it easier to adopt the right counter-cyclical policies, while governments with bad institutions do not.

What do they mean by “good quality governments”? Those that have: 1) a good investment profile, in terms of contract viability/no expropriation, profits repatriation, and lack of payment delays, 2) a strong anti-corruption stance, 3) law and order, i.e. a strong and impartial legal system and the popular observance of the law, 4) bureaucratic quality, i.e. the strength and expertise to govern without drastic changes in policy or interruptions in government services.

Why should good governments adopt the right policies? Political pressures for additional spending in good times (instead of in bad times when they are mostly needed!) are hard to resist and designing rules and institutions that aim at ensuring that fiscal revenues are saved in good times so that they are available in bad times would go a long way to alleviate the scourge of procyclical fiscal policy. Why should bad governments adopt the bad policies? “An important reason for procyclical spending is precisely that government receipts from taxes …. rise in booms, and the government cannot resist the temptation or political pressures to increase spending proportionately, or even more than proportionately”.

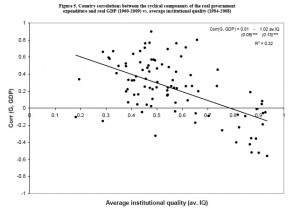

What do data show? The graph holds on the X-axis average institutional quality and on the Y-axis the prociclicality of fiscal policy as measured by the correlation between public spending and GDP: the higher that correlation the worse the use a government is making of fiscal policy. As you can see the relationship is negative: the higher the quality of government the more countercyclical i.e. the better is fiscal policy.

What do data show? The graph holds on the X-axis average institutional quality and on the Y-axis the prociclicality of fiscal policy as measured by the correlation between public spending and GDP: the higher that correlation the worse the use a government is making of fiscal policy. As you can see the relationship is negative: the higher the quality of government the more countercyclical i.e. the better is fiscal policy.

So what do we make of this? A lot. We are used to think that better government improves the quality of public services and therefore quality of institutions should be pursued. Well, now we know that there is another reason for fighting corruption, red tape, and more generally ensuring that reforms for better government are implemented. This reason is a timely and effective countercyclical fiscal policy, which, among other things ensures that in a recession fewer people are left behind, permanently unemployed. No small matter indeed!

Will Europe engage more forcefully in this fight for better government to achieve better countercyclical fiscal policy? Good question. There are reasons to worry about this.

Indeed, the authors worry about a possible reverse causality, that may run from cyclicality of fiscal policies to institutional quality and not the other way around. “For example, procyclical fiscal policies could increase the chances of governments running into debt sustainability problems during busts (rings a bell?). These critical financing needs could then lead to expropriation, repudiation of contracts, and/or intervention in independent branches of governments such as the judiciary system or the central bank (rings a bell?). Moreover, the turmoil typically associated with debt crises can exacerbate corruption in the political system thus weakening the foundations of an efficient and professional public administration.”

This crisis might thus have made our European institutions worse by adopting the wrong fiscal policies. But there is no reason not to fight even more forcefully to improve them.