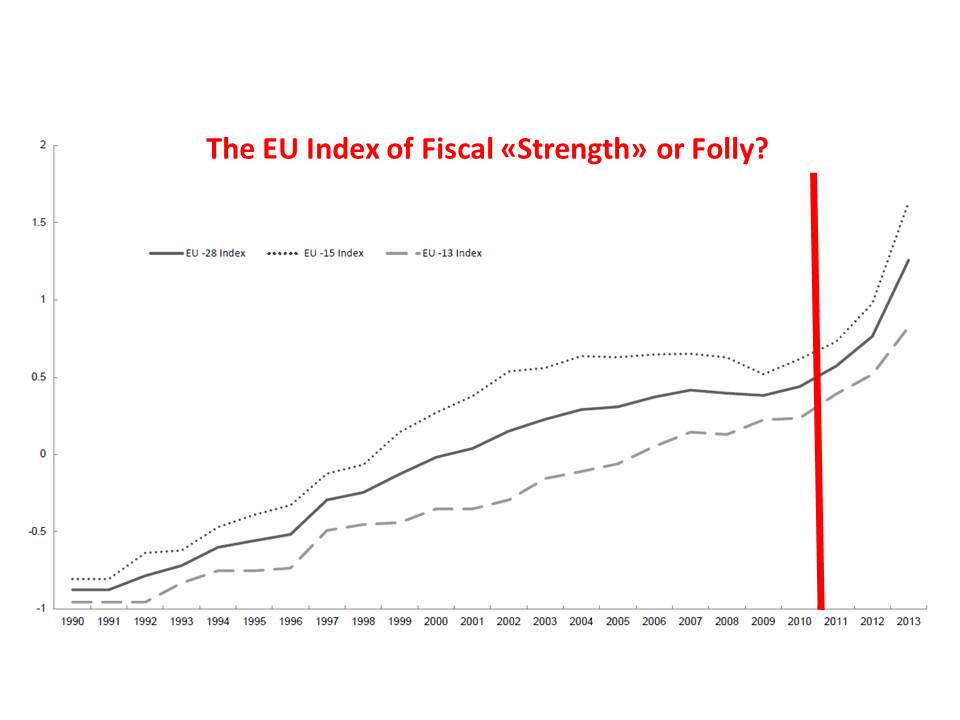

To be effective in containing budgetary imbalances, fiscal rules need to be equipped with appropriate characteristics within the institutional framework of budgetary policy: whether a fiscal rule will be respected or not depends to a large extent on its institutional features. To capture the influence of these features, DG ECFIN has constructed an index of strength of fiscal rules, using information on (i) the statutory base of the rule, (ii) room for setting or revising its objectives, (iii) the body in charge of monitoring respect and enforcement of the rule, (iv) the enforcement mechanisms relating to the rule, and (v) the media visibility of the rule.

http://ec.europa.eu/economy_finance/db_indicators/fiscal_governance/fiscal_rules/index_en.htm

*

At a moment when Europe is putting finally its head out of the sand and the private sector is pondering whether to re-enter the economy, at a moment in which euro devaluation, oil prices and interest rates decline are making the investment risk of some firms more palatable, it is quintessential that economic policy does not spoil this timid and very shy European recovery.

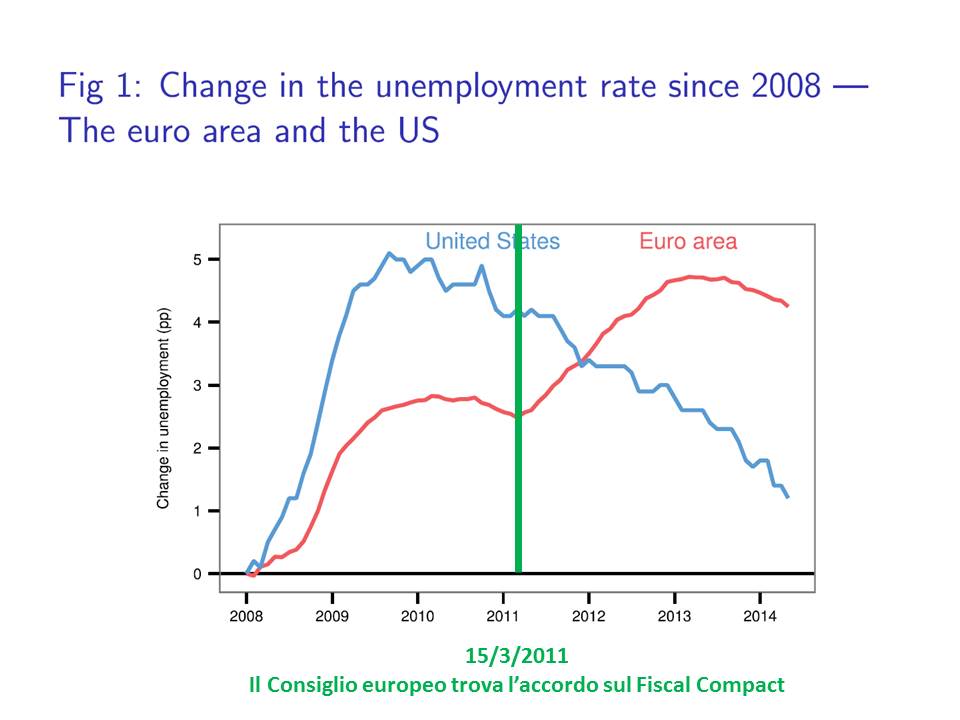

It has happened before. In 2010, as you can see from the graph, both the US and Europe – also thanks to a mild and not restrictive fiscal policy stance – were showing the same signs of pick-up. What happened after that in 2011 is a history we all know but that it is worth re-playing for the sake of the reader: the US blossomed, the euro are exploded in a second devastating recession, where firms backtracked and gave up on investing, scared away. By what? A crazy constitutional invention, the Fiscal Compact, which affected deeply continental expectations, for the worse. By asking all European governments to implement fiscal restrictions (higher taxes, lower spending no matter what the content of the spending) for several years ahead, consumers and firms understood that the signal governments were sending was one and one alone: “you are on your own, good luck, son!”. The graph clearly shows how a crisis US-driven starting in 2011 soon became a solid exclusive European madness.

Today we cannot afford to do the mistake twice. Europe cannot ask its member States to engage in additional fiscal restrictions at this critical juncture: it would imply a second and perhaps final collapse of the euro project, with social unrest driving the dominant political will in some key countries toward abandonment of the joint project for lack of hope.

Today we cannot afford to do the mistake twice. Europe cannot ask its member States to engage in additional fiscal restrictions at this critical juncture: it would imply a second and perhaps final collapse of the euro project, with social unrest driving the dominant political will in some key countries toward abandonment of the joint project for lack of hope.

The index of fiscal strength elaborated by the European Commission shows clearly what we have experienced in the past few years, the worse years of a self-made recession: the absurd increase of all indicators of fiscal retrenchment. They should have remained stable or declined, to help economies survive with some oxygen from the public sector but as you can see institutional restrictions madly accelerated, preventing internal demand in each country to support oneself and other member states recovery. April is the time when each government of the European Union presents its plans for the four years to come in terms of fiscal policy. It is quintessential that the fiscal stance becomes at least neutral, preventing further deficit reductions everywhere. It is quintessential that Greece is allowed to see its plans for social spending for the poorest implemented fully.

April is the time when each government of the European Union presents its plans for the four years to come in terms of fiscal policy. It is quintessential that the fiscal stance becomes at least neutral, preventing further deficit reductions everywhere. It is quintessential that Greece is allowed to see its plans for social spending for the poorest implemented fully.

If our small leaders do not show the courage that Greek leaders have had in representing their electorate ‘s suffering, no QE and no reform will save our European construction from its final geopolitical demise.