I do not understand the quasi-religious discussions about quantitative easing (QE). It is appropriate if economic conditions justify it, in particular in countries facing a liquidity trap that may lead to deflation. The instrument is implemented in the UK and US, where the central banks consider that there are risks of deflation and where the policy rate is constrained by the zero lower bound. This is currently not the case in the euro area because the ECB currently sees no risk of deflation. But if conditions changed and the need to further increase liquidity emerged, I would see no reason why such an instrument, tailor made for the specific characteristics of the euro area, should not be used.

I do not understand the quasi-religious discussions about quantitative easing (QE). It is appropriate if economic conditions justify it, in particular in countries facing a liquidity trap that may lead to deflation. The instrument is implemented in the UK and US, where the central banks consider that there are risks of deflation and where the policy rate is constrained by the zero lower bound. This is currently not the case in the euro area because the ECB currently sees no risk of deflation. But if conditions changed and the need to further increase liquidity emerged, I would see no reason why such an instrument, tailor made for the specific characteristics of the euro area, should not be used.

Lorenzo Bini Smaghi, Wednesday December 21 in Frankfurt: interview to the Financial Times

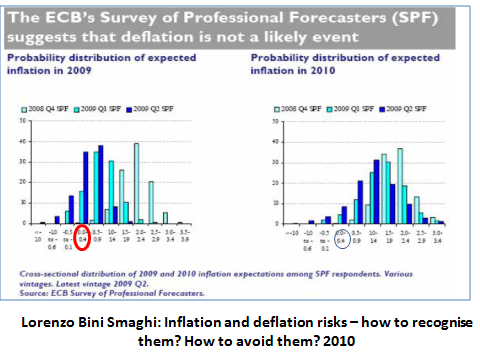

The Power Point slide you see above was shown by Lorenzo Bini Smaghi at a conference in Rome last year, mid Summer I think. Since then I have always used it in various seminars because I think it well represents the hawkish attitude of the ECB on the fight against inflation. First take a look at the title: forecasters “suggest deflation is not a likely event”, it says. On the left histogram you see inflation forecast by experts for 2009 and on the right for 2010. The circles point out zero-inflation expectation, the divide between expected deflation and inflation. Indeed, as Bini Smaghi hoped to convince us of, both graphs showed that expectations regarding deflation were held only by a minority of forecasters. So – here comes the gist of the argument of Bini Smaghi at the time – we don’t need to more expansive with our monetary policy than we currently are.

I will never forget that when Bini Smaghi finished his speech Jean Paul Fitoussi, not your typical orthodox economist, raised his hand to comment. He said to Bini Smaghi (I cannot remember by heart his words, but trust me on the general meaning): “I think your slide proves the contrary of what you claim. They show that many are still not convinced by your statement that deflation is an impossible event. And since deflation is a terrible thing that cannot occur – otherwise a vicious circle of unemployment and recession will be started – you must be more expansive with monetary policy than you are right now, showing markets that you fear deflation so much that you are adamant in fighting it as soon as its specter appears”.

I was reminded of this discussion when I read Bini Smaghi’s interview by the Financial Times and his claim that deflation was still at bay. No surprise there (after all the last Survey of Forecasters for 2012 gives only 0.7% probability to deflation). But I was also glad to see how much the central banker had learned from Fitoussi’s comment (the Florentine banker being so proud, he will never admit it). Let me explain why.

Notice that in his interview he seems to argue that strong monetary expansion (QE) should come about only when two conditions occur: a) a liquidity trap is in place and b) deflation is a growing risk. Bini Smaghi seems to call a liquidity trap a condition where central bank nominal rates are at zero level and cannot be lowered further. If deflation is close by, he correctly argues, in this case we risk having rapidly increasing real (i.e. corrected for inflation) rates of interest, that would be a drag on the economy. This risk is eliminated via a strong and aggressive monetary stance. But, you might argue, then do I have to understand that the ECB is doing nothing? After all, right now deflation is not a risk and rates are not zero.

Think again. A liquidity trap in its more Keynesian sense is a condition where expectations are so bearish that no injection of liquidity helps markets, because all liquidity is hoarded waiting for better times to come. A liquidity trap of this kind does not need to wait that short-term rates are equal to zero to materialize, it can happen even if short term rates are positive, actually it is happening right now in the euro area: you might have noticed that government spreads are untouched in the current scenario by ECB liquidity injections as banks do not lend it to the private sector nor do they buy government bonds at lower rates, since their perception risk is always the same.

A liquidity trap of this kind is a nightmare for a central bank because its power to affect rates and thereby the economy is muted. This is clear from Bini Smaghi’s comment that the current spreads along the whole yield curve may raise some doubts about whether we indeed have a single monetary policy in the euro area today and whether the ECB is indeed fulfilling its mandate.

Should we thus believe that the current monetary policy stance of the ECB is useless? Not at all. By supplying all this liquidity – that does not affect directly economic activity through lower long-term rates and lower spreads – the ECB is useful nevertheless (very useful!) in shaping expectations regarding inflation and keeping deflation at bay.

So get the picture: we are in a liquidity trap, deflation is a risk and by injecting liquidity the ECB is helping deflation (and its terrible consequences) not to materialize, even though it does not help directly the economy through lower spreads. So stop looking at spreads and stop saying that the ECB is not doing its job. It is doing the most it can (maybe a bit more can be done, but let’s not be picky here) and even if you don’t notice it is quite a lot: without it, things would be much worse, as US citizens in the early 1930s learned too well.

Spreads will go down when markets will be convinced that euro governments know how to fight this crisis. How so? Next post.

24/01/2012 @ 04:25

Hi,

My name is Zib Kozak, and I wish to thank you writing a great article. I am a student and do research reports for both public and private companies currently.

I was wondering what your comments are regarding the near-zero interest rates on both sides of the Atlantic, QE (I and II) in the U.S., and the respective problems of banks re-buying sovereign debt with money they were re-capitalized. I noticed a dramatic swing in banks being heavily capitalized by markets, not deposits. With banks selecting large companies opposed to SME’s (where all the jobs are), does this not create an atmosphere of conglomeration opposed to competition (of particular note would be the number of U.S. banks being swallowed by big banks and cheap debt). I am really concerned about such issue’s as I feel that the quote of Rothschild is coming true (not exact quote but extremely close): “Russia, Communism, it’s great – I only have to go to 1 person for the entire country.”

As I started doing reports back in 2007 on what in the World was going on, I always thought the Fed would raise rates soon after QE I in order to be able to control deflation w/ lowering the interest rates. 5 years on, they have no room to move but with the printing of money. This destroys reserve accounts across the Globe, and puts emerging markets in peculiar positions as to which reserve currencies they should use (of note would be the Euro before the collapse, and the Swiss Franc which led to intervention by the Swiss government).

What the hell is going on!

Please, keep posting!

Thank You,

ZKozak