Welcome to the land of the blunders of economic policy, Greece. The International Monetary Fund just released its Fifth Review of Greece Under the Stand-By Arrangement and it does not look good, not even to the usually bullish Austerity- providers located in Washington DC.

So, where has the dogma of spending cuts and tax hikes plus reforms led us? In Greece, like most often it does, into a vicious circle of a recession with no achievement whatsoever in terms of fiscal balance and reforms.

Listen to the IMF and ponder carefully: “Meanwhile, since the fourth review, the economic situation in Greece has taken a turn for the worse, with the economy increasingly adjusting through recession and related wage-price channels, rather than through structural reform-driven increases in productivity…. Structural reforms have not yet delivered expected results, in part due to a disconnect between legislation and implementation.”

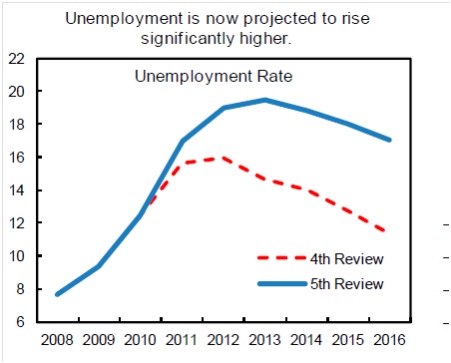

How much worse? “Concerning GDP growth, data revisions show that the cumulative recession by end-2010 was deeper and first quarter 2011 growth weaker than understood at the time of the fourth review. Indicators of economic activity (e.g. retail trade, construction, and industrial production) suggest that the decline of domestic demand continued unabated during the third quarter. Labor market conditions have deteriorated sharply, with unemployment reaching 16.5 percent in July 2011”.

Oh, but maybe the fiscal balance at least has done better. Try again: “after the large consolidation realized during 2010, the fiscal position has taken a turn for the worse during 2011, as the recession deepened and policy implementation slipped.”

And why would that be? “The revenue shortfall in the state budget has reached some €1.7 billion (¾ percent of GDP), with a drop in VAT efficiency signaling compliance problems. Significant shortfalls in social security contributions—well beyond developments in the economy-wide wage bill—also suggest deteriorating compliance by firms (likely due to liquidity constraints).”

Maybe reforms have worked for the better? No. “After continued slow progress with reforms for a third straight review cycle and with growing evidence of deepening macro adjustment, the authorities and IMF/EC/ECB staff all recognized that a significant revision of the outlook and some changes in the policy framework would be needed.”

But, unfortunately, there is no hope this perverse logic will change. Read for yourself: “Greece has some impressive program achievements to its credit. During 2010–11 the fiscal deficit has been reduced by 5 percentage points, despite a contraction in GDP of almost 10 percent during these two years.” Wow. How would you like to read something of the following: “Greece has some impressive results to show. Thanks to its stimulus to GDP through public spending financed by taxes, the fiscal deficit has disappeared”. No, not this time, not on this planet. Even though “… the notably weaker-than-expected economy and the attendant contraction in the revenue base is a key reason why the authorities are struggling to meet their fiscal targets and face a need for significant new measures.” What am I missing here? If we know that weaker growth generates worse deficits and weaker growth comes from fiscal consolidation, what stops us from doing fiscal expansion that generates growth and lowers deficits? Why so much lack of logic? Why are we creating recessions that raise the debt to GDP to levels that “cannot be considered sustainable”?

Italy is next. Do we really want this?

14/02/2012 @ 23:31

Meraviglioso, informazioni molto utili