Will M. Hollande make it? Will he change Europe and save the euro?

Will M. Hollande make it? Will he change Europe and save the euro?

To be on the safe side, the President of the German Bundesbank launches the attack before M. Hollande has had time to have the first breath as President de La Repubblique. And quite an attack it is: “Monetary policy in the eurozone is geared towards monetary union as a whole; a very expansionary stance for Germany therefore has to be dealt with by other, national instruments.” As Krugman explains: “I’m pretty sure that this is code for saying that Germany will try to prevent any inflationary impact of low ECB rates with fiscal contraction. Austerity for all!”.

But this is fair game. We should expect the Germans to be nipping at the French’s ankles. The key issue is how will M. Hollande react to this. Somebody’s already saying there will be no true reaction. No true battle. Surrender to austerity.

I worry about this. I like Hollande. But his first statement on victory night was: “l’austerité n’est pas une fatalité”. Austerity is not mandatory. OK, although it could have been stronger, something like: “l’austerité est intolerable” and I don’t need to translate. It would have set the right tone for the battle. In the necessary confrontational mode.

Because no greater risk than settling for the lowest common denominator, the mantra that one can read ad nauseam these days in Europe: “austerity is necessary but not sufficient” to generate growth. Wrong. In this recession, austerity is neither sufficient (obviously) nor necessary to generate growth.

Because growth is a pre-condition for rigor, for stability of public accounts. With no growth, no stability. With austerity, so long growth, so long stability.

Thank God we have the International Monetary Fund (IMF) to remind us of that. The April IMF Fiscal Monitor is out. Its title is “Balancing Fiscal Risks” but the true star of the report is the word … “multiplier”, cited 117 times. The multiplier: how much output changes when public spending changes.

And the results are quite clear: “Fiscal tightening can generally be expected to reduce short-term growth, but the negative impact of tightening may be amplified by some features of the current economic landscape…”

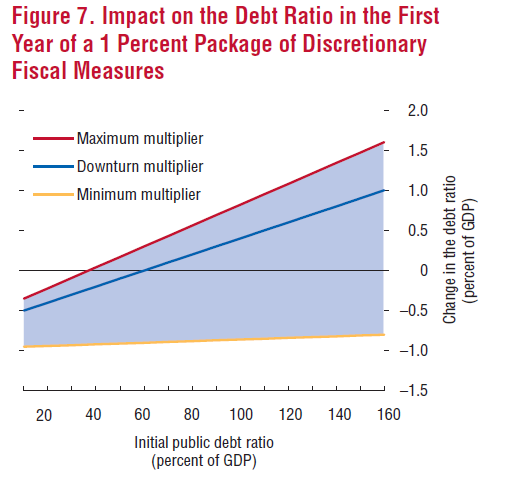

Yes. Let’s see what lanscape we are talking about here. What matters for M. Hollande is the following graph.

It shows that “… when multipliers are large and/or the initial level of public debt is high, fiscal adjustment may affect debt ratios only with a lag and may even appear counterproductive in the short run. Figure 7 shows the hypothetical change in the public debt ratio with respect to the baseline after a government introduces a package of discretionary fiscal measures of 1 percentage point of GDP. Assuming an average first-year fiscal multiplier of 1.0, in countries where government debt is above 60 percent of GDP, the direct effect of fiscal consolidation on the debt ratio is likely to be more than totally off set in the first year by the indirect effect of a lower GDP.”

It shows that “… when multipliers are large and/or the initial level of public debt is high, fiscal adjustment may affect debt ratios only with a lag and may even appear counterproductive in the short run. Figure 7 shows the hypothetical change in the public debt ratio with respect to the baseline after a government introduces a package of discretionary fiscal measures of 1 percentage point of GDP. Assuming an average first-year fiscal multiplier of 1.0, in countries where government debt is above 60 percent of GDP, the direct effect of fiscal consolidation on the debt ratio is likely to be more than totally off set in the first year by the indirect effect of a lower GDP.”

In less technical terms: take Italy for example, let it raise (and not cut) public spending by 1% of GDP. Not only will employment and GDP rise, but so will stability: the debt-GDP ratio would decline by 1%.

Growth, and not austerity, ensures stability.

M. Hollande, first moves are critical. Your strength will be judged in these critical first few weeks. Go forward for the future of our euro. Attack. Put austerity under attack. Under trial. Relentlessly. Bargain relentlessly. Do not flinch. Not even one inch.

What is at stake is the euro. Nothing less, nothing more. The future of so many generations is likely to be in your hands. Nothing less, nothing more. We are with you. Don’t settle for anything less than the death of austerity.

09/05/2012 @ 08:29

Speriamo bene Professore!

Sta mattina sentivo Monti in radio che finalmente diceva anche lui “qualcosa di keynesiano”, per dirla alla Nanni Moretti…

Ho la sensazione che questa sia una delle ultime opportunità, non è ammissibile tutto questo dolore, nel 2012, in una Europa che ha già versato il suo sudore per arrivare fino a qua.

09/05/2012 @ 18:11

In Italy:

death of austerity = death for future generations.

Austerity = death of the 40 year old farse of the Italian government and PA.

Of course, austerity needs to be total, relentless and extremely painful. No pain, no gain. The only way out of the italian imbroglio che ci rovina da decenni.

Let the euro disappear.