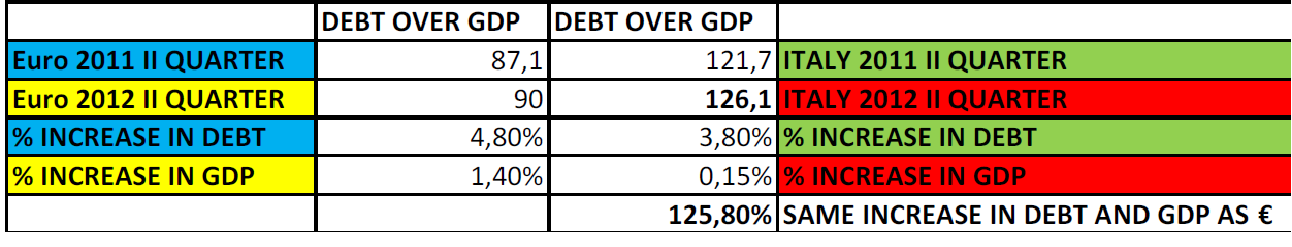

So the numbers are out (see below). And, guess what. Euro 17 area debt is on its way up. Oops, sorry, I meant debt over GDP is up. Huge difference bewteen the 2 things. This is the best way of summing up the disaster of euro austerity policies: more taxes, less public spending, higher deficits via lower GDP, higher debts. And the ratio goes up and up and up: 2.9% in just 1 year, touching the 90% threshold.

Italy? Oh Italy is there, just like the euro area. With some differences. The dramatic impact of greater than average austerity shows up in a higher debt over GDP by 4.4% (even though we have given 0.8% of our GDP in help to countries with even worse outlooks…). And who has been the worst offender of the 2? The public debt or GDP? Well, debt has grown less than in the EU. It is the economic growth disastrous performance (0.15% from last quarter to this quarter) that explains our worse performance.

Best way to see it? Imagine Italy had had the higher debt increase of the euro area (+4.8% instead of 3.8%), maybe because of less restrictive fiscal policies, and as a consequence a higher growth rate of GDP, possibly the same as the euro area one (+1.4% rather than +0.15%): what would happened to debt over GDP?

Got it, it would have been lower: 125,8 rather than 126,1%.

Thank you, austerity.