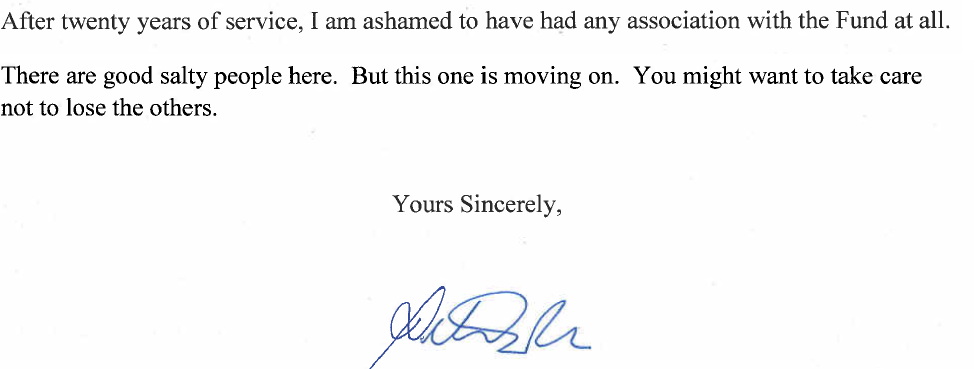

The International Monetary Fund report on the euro area is out. Equally out is Dr. Doyle, who resigned from the organization with the following words:

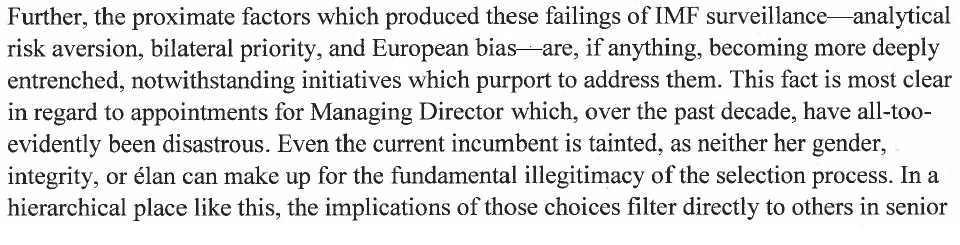

The issues, Europe and Doyle, are related. Not only because Dr. Doyle mentions the European-bias as a critical failure of the IMF:

But also because the IMF itself had recognized the issue clearly before:

“The Fund should not have a “Europe is different” mind-set. Facts have proven that countries in the euro area can experience crises of the sort that is frequent in the emerging world. In its surveillance work the Fund should make full use of its comparative advantage which consists of the breadth of its expertise, the wealth of its experience across countries and over time, and an approach that is driven first and foremost by economic analysis rather than by institutional constraints… The Fund should take notice of the EU’s institutional constraints but it should not be bound by them. The EU by nature is process-driven and this affects its own surveillance work, which is structured around institutions and procedures. Furthermore, European processes are inevitably affected by power games between national governments and EU authorities (Council, Commission, Parliament and ECB). Being outside of this game gives the Fund freedom and objectivity. Those are precious assets that should not be squandered by attempts to be part of the European institutional game and to mimic European processes… Attempts to limit the scope of Fund surveillance or to tone down its assessments should be resisted. The Fund‘s expertise and financial commitment in the euro area give it a duty towards its entire membership to be as thorough and comprehensive as needed.”

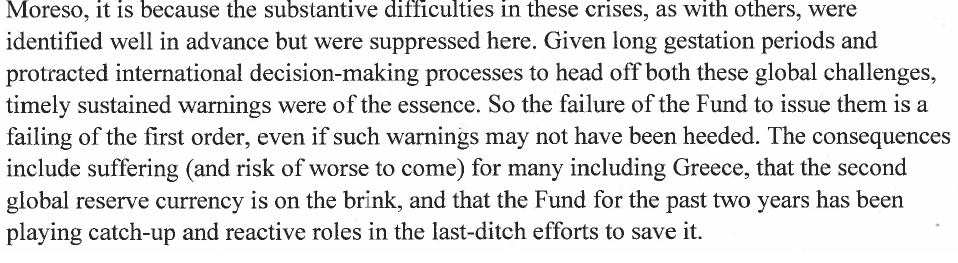

I know a bit of this matter too. Many years ago I watched so-called independent supra-national institutions turn their back on the evidence of the wrong accounting practices by some governments on the use of derivatives. They knew, they were told not to meddle, they abided. Countries like Greece suffered immensely from this, just like they do now according to Doyle:

Optimistically, forgetting for a second Dr. Doyles’s resignation, things might have changed in the meantime and the IMF might have acquired more candor and traction (defined by the IMF as “the extent to which the authorities engage with the Fund on its advice or the extent to which Fund advice translates into policy action”). For example, in this last report on Europe there is growing pressure on the ECB, the European Central Bank, to act fast in support of the economy.

But from reading it all, I do not think enough has been done yet to change the IMF ways of working. In its 2011 triennal review of surveillance operations the IMF had asked its staff and external advisors to enquire as to whether, on stimulus and exit policies, the Fund’s policy advice in this area had proven useful for country authorities and had had a consistent framework for analysis applied across countries that took into account both growth/employment and sustainability considerations.

In the final report that followed, the IMF Managing Director writes that indeed “the revised surveillance guidance note will urge better coverage of issues involving unemployment, inequality and inclusive growth, where they are macro-critical, leveraging expertise in other organizations”.

Hélas. There is little regarding these issues in the latest report on the euro area. Very little.

What is more, one finds embedded in it only one possible model of the economy. In its external advice to the IMF last year, Nobel prize Joe Stiglitz had warned the IMF: “for IMF surveillance to be more effective, there needs to be more explorations of the consequences of different ways of modeling the economy. If, for instance (as some recent IMF papers suggest) inequality contributes to instability, then making labor markets more flexible may not only lead to more inequality, but more instability. If, as many economists believe today, there is a deficiency of aggregate demand in many countries, more labor market flexibility may lead to higher, not lower, unemployment. If, as Irving Fisher argued, deep recessions and depressions are related to a debt-deflation cycle, then so are more wage and price flexibility risks pushing the economy further into recession”.

None of that intuition can be found in the euro area report of the IMF. In this review of the euro area we can read that “to reduce deficits and debt that have risen sharply in recent years, most euro area countries plan significant fiscal adjustment over the medium term. In this setting, the overarching challenge is to implement consolidation plans without exacerbating the adverse feedback loops with the real economy. Countries where market pressure is high have little choice but to proceed rapidly with consolidation. But the adjustment elsewhere should be conducted at a steady underlying pace that balances the need to bring down deficits and to support the recovery.”

On the basis of this comment, it is obvious that Greece, Portugal, Spain and Italy will not count on the IMF to support a possible expansionary fiscal stance when asked by the European Commission to do instead more austerity. My point: why is the IMF so sure that were these countries to pursue expansive fiscal policies they would not get out of trouble sooner and more effectively? What evidence do they bring for such an important statement of theirs? Why have they not proposed the possibility also of a second scenario? Have they considered Stiglitz statement in writing those words cited above?

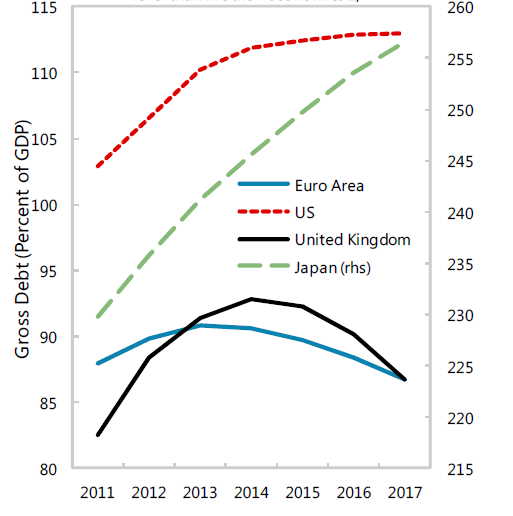

Page 30 of the euro area report shows the US and Japanese public debt to GDP dynamics, much more dramatic than the one even of Italy and certainly of the whole euro area. Why are Japan and the US not facing a crisis of the kind the euro area is? Possibly because the level of public debt to GDP has little to do with it? And so why should countries with a high public debt ratio focus on austerity rather than expansion? Why? None is said.

Is the IMF still too dependent on Europe’s politicians suggestions? I fear so. The road to independence and intellectual freedom of analysis, I fear, is still to be conquered at the IMF. As long as it won’t be, the public good embedded in the IMF mission, providing honest and competent opinion on complex international economic policy matters, will remain a chimera. And people will suffer from the absence of this public good, much much more than the suffering of these past 20 years of Dr. Doyle.

22/07/2012 @ 16:26

Mi scusi c’è una cosa che mi lascia molto perplesso.

Lei scrive:

“And so why should countries with a high public debt ratio focus on austerity rather than expansion? Why? None is said.”

Ma sembra che anche nel suo blog “none is said”, non crede?

Ha una sua spiegazione sul perché i paesi ad alto debito pubblico continuino a applicare politiche di austerità piuttosto che di espansione?

22/07/2012 @ 16:31

Sul why should questo blog è pieno. E’ sul why would che sono piuttosto in imbarazzo a risponderle.

22/07/2012 @ 16:56

E none is said anche qui.

22/07/2012 @ 17:16

Se mi stimola… Penso non abbiano in testa il giusto modello di come funziona l’economia per questa situazione.

22/07/2012 @ 19:21

Lei cerca di tenere aperti degli spazi che possano consentire una mediazione. Quali potrebbero essere i segni che le dimostrino che questa mediazione non è più possibile?

22/07/2012 @ 22:27

La svalutazione

23/07/2012 @ 08:05

Scusi Professore,

sa che di economia ci capisco poco, ma con svalutazione intende questo:

“L’euro crolla ai minimi contro dollaro e yen” ?

http://www.ilsole24ore.com/art/finanza-e-mercati/2012-07-23/euro-minimi-anni-contro-080000.shtml?uuid=AbPjVGCG

23/07/2012 @ 10:03

Ore 11:58, FTSEMIB -4,95% ed è solo l’ inizio.

Calma e gesso…Forza Mario…

Ma il bello cari, lo vederete non quando fra pochissimo la crisi colpirà in pieno gli italiani e gli spagnoli (mo’ stamo ancora a scherzà) ma prima, il salto di qualità iniziale, sarà quando arriverà in Francia e poi il botto quello vero ci sarà quando comincerà a saltare la Germania che non sta messa affatto bene al contrario di quanto si vuol far credere e che non reggerà l’ impatto. Il problema è che i latini se si arrabbiano spaccano tutto nel loro paese, i tedeschi invece, per una simpatica tradizione popolare teutonica, vanno a spaccare tutto in quello degli altri.

L’ inevitabile fine dell’ euro ci riporterà ai vecchi nazionalismi aggravati dal rancore e dalle reciproche recriminazioni incancrenite definitivamente dalla perniciosa abitudine vetero europea della mediazione a tutti i costi che ha prevalso sul coraggio e sull’ evangelico parlare “sì-sì, no-no”. Il lato positivo è che ci saranno delle situazioni che consentiranno di levarsi più di una soddisfazione “a gratise”.