The new ECB report on the access to finance of SMEs in Europe is out. It depicts the usual bleak scenario, albeit slightly improved on average, vastly different across countries of the euro area.

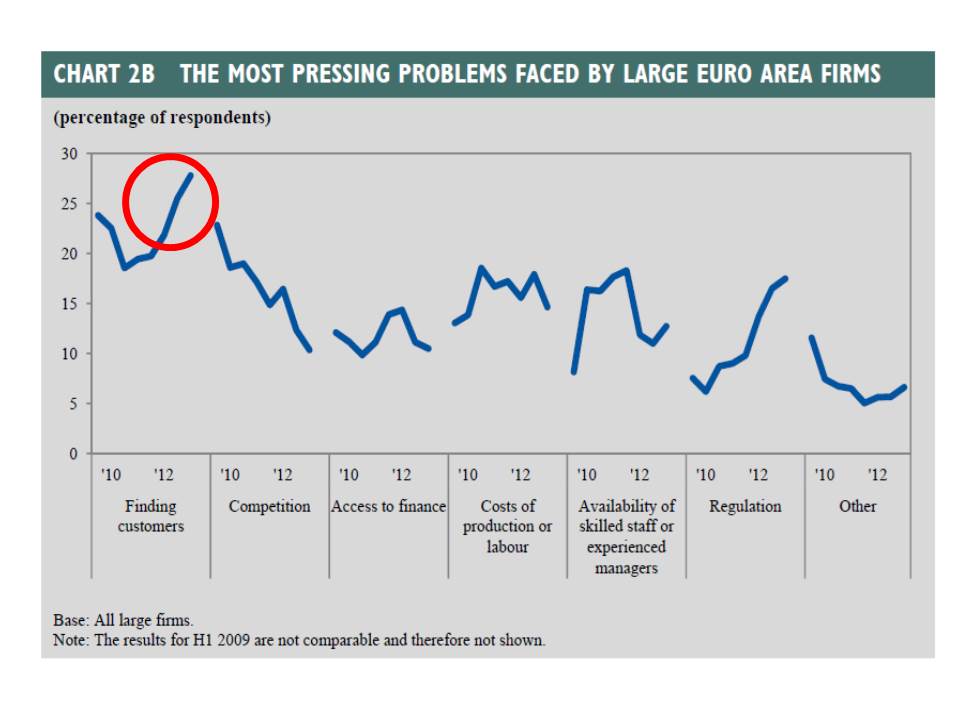

The most striking feature? The report usually asks small and large firms what their largest problem is right now. It has always been only one: not competition, not finance, not labor costs, not regulation. The lack of clients, i.e. demand (internal demand one would dare to say).

However never had it been so high for large firms.

One wonders why European institutions are oblivious to the problems of firms and do not react by instilling the only solution to this crisis in the economy: more public spending through procurement, in deficit in the North, financed by cuts in public waste in the South.

Instead one has to read the delirious recommendations of the EC to, for example, Italy: your debt-GDP ratio is too high because of low GDP, thus please do more austerity to fix it, with no seemingly rational understanding that austerity will drive the debt-GDP ratio even higher.

17/11/2013 @ 14:37

Gentile Professore, potrebbe urlar lo in italiano. Grazie

18/11/2013 @ 18:08

your debt-GDP ratio is too high because of low GDP, thus please do more austerity to fix it

they mean a long term delevering (anyway has Ecb ever care of growth ? – rhetoric-

18/11/2013 @ 18:33

Berlin Remains Stubborn

Last week, the International Monetary Fund (IMF) demanded that Berlin make a change of course. According to reports, during his visit in the German Ministry of Finances, the IMF’s Special Advisor to the Managing Director, David Lipton, demanded that Germany, at long last, reduce its foreign trade surpluses, in addition, he called on the German government to determine an upper limit, not to be surpassed.[4] Berlin strictly refused. It is out of the question to stimulate demand in Germany with an increase in wages. On the contrary, the countries suffering under the German export offensive should undertake “structural adjustments,” meaning cuts in wages and social services, along the lines of the notorious German “Hartz reforms.”[5] The disputes will escalate; the EU Commission may even officially reprimand Germany this week. It is not expected that Germany will give in. Low wages and excessive exports are flushing huge profits into the coffers of German companies, facilitating further expansion. Though this threatens to plunge numerous countries – and eventually even the global economy – into a severe crisis, it is, nevertheless, increasing German wealth and German power; a good reason for Berlin to continue on its current course.

11/11

http://www.german-foreign-policy.com/en/fulltext/58695