For those who think that the worse the IMF can do to Greece is what Madame Lagarde said yesterday (“I think more of the little kids from a school in a little village in Niger who get teaching two hours a day, sharing one chair for three of them, and who are very keen to get an education,” she said in an interview with the U.K.’s Guardian newspaper published Saturday. “I have them in my mind all the time. Because I think they need even more help than the people in Athens. So, you know what? As far as Athens is concerned, I also think about all those people who are trying to escape tax all the time“) think again.

There is much worse than that. Like, consistently forecasting the wrong impact of IMF and EC-led austerity policies on Greece for at least the last 3 years.

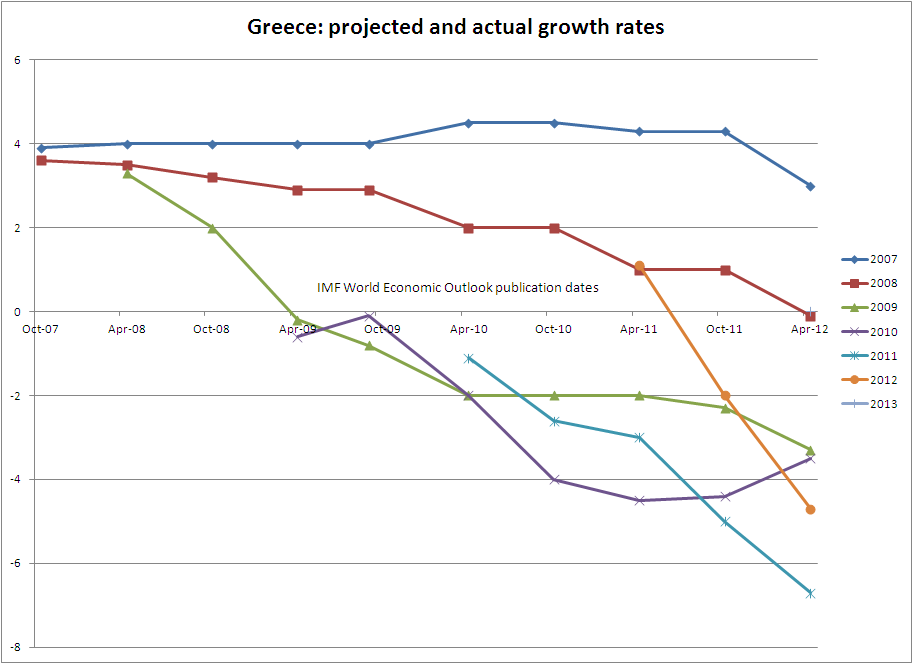

From Dani Rodrik’s blog, here are the constant updates over these years of the Greek economy tendencies, always based on an overestimate of economic growth following austerity recommendations by various institutions, the IMF included.

These estimates had a strong political content: they have been used over and over again to minimize the impact of austerity. To be fair with the IMF, it has also recognized its mistakes on dealing with Greek policy , but the recommended stance has remained austerity-based all along.

Why have these mistakes occurred? Partly because it is hard to disintangle exogenous events that can always affect estimates. But there can be another source for these mistakes: political pressure on the IMF.

These political pressures were mentioned by the IMF itself. Indeed, the IMF had been here before, during the 2008 crisis, when it asked itself, in one of the few relevant self-examinations of its past mistakes (IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07 ) whether it had done all it could to live up to the standards of the IMF mission, and the answer was a “maybe” at best:

The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. Weak internal governance, lack of incentives to work across units and raise contrarian views, and a review process that did not “connect the dots” or ensure follow-up also played an important role, while political constraints may have also had some impact.

One might think that, in the case of Greece, political pressure would come from Greek politicians to “window-dress” accounts. Laughable. Nothing would be more distant from the true source of dangerous pressures. The IMF should have instead been capable of defending itself from pressure from the banking sector and governments that had an interest in the reimbursement of Greek debt no matter what. A selected group of institutions to which the IMF can hardly resist to listen, unlike to a weak Greek government.

Key question: what steps has the IMF adopted to resist such pressures that can affect forecasts and in turn the right recommendations of economic policy?

The same 2008 report claimed in its conclusions:

“On issues of systemic importance, the Fund should be ready to err more often in the direction of emphasizing risks and vulnerabilities, rather than focusing on possible benign scenarios. This change in approach would need to be discussed and agreed by the membership at large.”

Well, take a look at the above scenarios and their updates: it does certainly not look like an institution, the IMF; that has erred on the size of emphasizing risks and vulnerabilities.