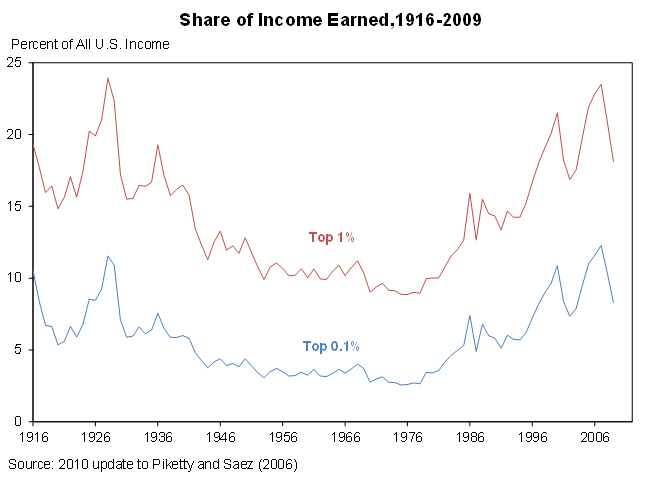

As you may recall, I mentioned the theory that the credit boom and bust of the late 1920s and mid 2000s might have been driven by rising inequality that pushed individuals that turned out to be non-solvent to borrow to keep consumption equal to the one of their solvent and richer peers. Inequality, in this idea, would explain both credit booms and busts. The graph below certainly entertains that thought.

As it occurs many times, thank God, I discovered not being the lonely one in this planet to have had this idea. In particular is was presented by Raghuram Rajan in his 2010 book, Fault Lines.

Now. Somebody worked on proving us wrong. And some smart guys too: Proff. Bordo and Meissner , who study empirically the phenomenon for 14 countries (Australia (1880-2008), Canada (1880-2008), Denmark (1891-2008), France (1886-2008), Germany (1889-2008), Italy (1880-2008), Japan (1894-2008), Netherlands (1906-2008), Norway (1880-2008), Spain (1906-2008), Sweden (1880-2008), Switzerland (1912-2008), United Kingdom (1886-2007), and the United States (1902-2008)).

Their paper is not yet published in a journal and we should exercise caution. Anyway let’s go to the point. They find (argue) that credit booms cause banking crises. So the key question that remains is, what causes credit growth: inequality? Other factors like innovations and upswings or monetary policy?

They end-up dismissing the view that increasing inequality drives credit booms. They find no such empirical relationship in the 14 countries. Indeed, for them inequality and credit booms might be created by a third factor, an economic upswing, but inequality did not cause credit booms:

For the 1920s, time series for the US show that the share of income earned by the top 1% increased from 15% in 1922 to 18.42% in 1929. Research based on top-incomes, as well as early work by Williamson and Lindert (1980), identify this as a period of rising income inequality. However, this rise in income inequality does not seem to be associated with any stagnation in real wages for the working class. Indeed annual income of nonfarm employees rose grew at an average of 1.89 percent or a total of 23 percent between 1919 and 1929. In addition, rises in the standard of living must have been even greater. Leisure increased in this period as the standard work week fell to 48 hours by 1929. The introduction of electrification, better indoor plumbing and a host of new consumer durables including automobiles, radio, washing machines and refrigerators, made home production more efficient and leisure more enjoyable. At the same time, as credit allegedly “boomed” in the 1920s, the economy grew largely above trend from 1923 up to 1929.

OK. Suppose they are right and that there was no “bad credit-demand boom” due to inequality here at work. My question is: are we sure that inequality plays anyway no other role in such crises? I ask this because I noticed that the 2 authors do not enquire as to why credit booms ultimately cause financial crises.

And then another idea came to mind (wow!).

It came when I read of recent experiments by Californian University of Berkeley psychologists that suggest that people who are socially and financially better-off are more likely to lie, cheat, and otherwise behave unethically compared to individuals who occupy lower rungs of the socioeconomic ladder (“We’re not saying you should distrust the rich, or the rich are corrupt,” says Piff. “Instead, this highlights the disparities in social environments that different positions occupied give rise to almost natural tendencies and divergent social values”. “What accounts for this divergence? The independence offered by financial security may foster a sense of entitlement and a lack of concern for others, the authors suggest. On a more concrete level, affluent people may be more likely to get away with misbehavior (because they are less supervised at work, for example), and they may be more willing to take ethical risks because they have the resources to bail themselves out – both literally and figuratively – if they get caught.) Add to that, says my friend Paolo, a sense of impunity and the capacity to afford the best lawyers and access to powerful networks.

Anyhow.

I wonder, after reading this, if there might not indeed exist an impact of inequality on crises, but not so much a direct one that goes through causing a (fragile) credit boom (as Rajan and I were arguing), but rather one that impacts on the likelihood of financial crises given a credit boom (something that Bordo and Meissner do not check). So inequality does NOT cause credit booms but it raises the chances that a (growth-driven) credit boom, if accompanied by greater inequality, might go more easily bust because of greater frauds and less ethics in the system.

I like this theory. I find it possible. Yes, financial crises would be more likely to occur with credit booms when inequality increases because of more dishonesty in richer individuals. The presence of more dishonesty in individuals that are more likely – because of their greater wealth – to receive loans and thus more likely to default on them given their dishonest behavior would explain why much of the busts in credit cycles is accompanied by many stories of fraud and scoundrels, as Kindlerberger used to call them.

Thank you Paolo.