This time it is not different. Carmen Reinhart and Kenneth Rogoff try again, in their latest fatigue “From financial crisis to debt crisis” published in the American Economic Review, to disentangle causal patterns between debt, banking and currency crises. “The main results … are that systemic banking crises in financial centers help explain domestic banking crises, and domestic banking crises help explain sovereign default”.

They do check, among other things, as to whether governments that take on “massive debts from private banks” undermine their own solvency. They dwell into “hidden debts”, when “government debt burdens often come pouring out of the woodwork, exposing solvency issues about which the public seemed blissfully unaware”, like, they say, the Goldman Sachs swaps with the Greek government. Most important for my argument, they mention that “in many economies the range of implicit government guarantees is breathtaking”.

This is related to the Economist article I read last night. Where it is argued that a “concern for 2012 is that banks’ own high borrowing rates will feed through to the high cost and low availability of credit for households and, particularly, small businesses. But can anything be done about it, or have all the expansionary policy levers been used? … individual governments can use their reputation for repaying debts to help soothe bond investors’ concerns over banks’ ability to pay theirs. This would be done using a debt guarantee from finance ministries which would cut banks’ debt costs”. They also admit that “the drawback of such a guarantee would be that it could expose governments if banks did not meet their debt obligations. This risk of this happening—even if it didn’t actually happen—could push EU governments’ borrowing costs up”.

I frankly doubt that lower yields for banks would translate into less credit crunch for SMEs: banks currently do not lend, full stop.

Anyway, the writers of the piece try to quantify the potential gains of these guarantees by looking at which countries have government yields very much lower than bank yields: France, Germany and United Kingdom. But not Spain, yields are already too close, they say. Not Italy, for the same reason: “Italy has no room to consider this kind of policy”. Pity to incur in this mistake dear Economist. Because Italy used guarantees already in its December 6th budget package by Mr. Monti’s government.

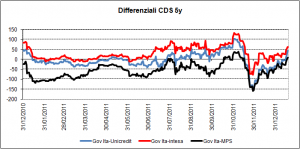

But check this out: the spreads between Italian government yields and those of 3 major Italian banks. A positive value is that rare occasion in which a Government bond is considered riskier than the bank bond.

But check this out: the spreads between Italian government yields and those of 3 major Italian banks. A positive value is that rare occasion in which a Government bond is considered riskier than the bank bond.

Notice that in the first part of the year 2011 Intesa Bank is perceived as less risky than the Government. A Berlusconi specific risk? It would seem so, if one considers that the spread returns negative as it should be in the period in which Monti arrives as PM, end of November, and the public guarantees to banks are approved.

But take a look at today’s spreads: for the first time in one year all spreads, including the one of Monte dei Paschi di Siena (always considered the weakest of the 3 banks) are positive. The Monti government seems to be considered more risky than banks. Since the spread on Italian governments is declining, this does not imply that the government is becoming riskier than before, but riskier than banks. The guarantee is working as the Economist expected, transferring risk away from bank’s balance sheet. Will it improve credit to firms and SMEs? I doubt it. But, most of all, does this imply that the risk of a hidden debt in the public accounts of Italy is starting to be present and priced ? We should fear this, if we believe even a little bit what Reinhart and Rogoff say about how banking crises spread and become debt crises that touch taxpayers rather than (reckless or incompetent) bankers that furthermore do not lend to the economy.