The prisoner’s dilemma can be considered as the prototype, or blueprint, of social dilemma research. The prisoner’s dilemma was designed by Melvin Dresher and Merrill Flood, two scientists at the RAND Corporation, but received its name by Albert W. Tucker (see for an overview on the origins of the prisoner’s dilemma game Poundstone, 1992). The dilemma is often used as a metaphor of the cold war, where two blocks (east and west) are in conflict while sharing a common interest (preserve peace). In prisoner’s dilemma games, individuals can choose between furthering their own outcome (i.e., the defect option) and furthering their collective interest (i.e., the cooperation option). The collective outcomes are higher if both players cooperate. However, if both players only try to maximize their own outcomes, this potential will not be reached. For these reasons, the dilemma can also be described as a clash of ‘individual rationality’ (maximize the own outcomes) and ‘collective rationality’ (maximize the collective outcomes).

https://www.sciencedirect.com/topics/social-sciences/prisoners-dilemma

*

Italy and rest of the rest of the European Union member countries share the common interest of preserving the European Union project for the sake of peace and/or progress, empowerment, security… However these two actors (Italy on the one hand and the EU member states that are not Italy on the other) can either choose between furthering their own outcome or the collective interest.

Imagine now that the respective collective outcomes are higher if our two players cooperate. However, if Italy and the Rest of the EU only try to maximize their own outcomes, this potential will not be reached. In this case, by definition, we would reach a prisoner’s dilemma negative outome that is indeed dominated by an ideal cooperative outcome, which will not be reached for a failure of cooperation. This would be a prisoner’s dilemma involving Italy on the one hand and the Rest of the European Union on the other.

Question: is there any possible prisoner’s dilemma occuring right now in the relationship between Italy and the rest of the European Union?

Indeed we argue there is, and it is one of such gravity that debating about it, after illustrating it, at all political levels is the thing we believe that matters the most in European affairs right now, because of its potential, if not fixed, to destroy the whole Union.

We therefore proceed to describe the game both parties are currently involved in, hoping that this will enhance the search for a solution on key issues such as the reform of the Stability Pact in the EU and of economic reforms in Italy.

*

Strategies available

Imagine a game where the actor called Rest of the European Union, confronting the actor Italy, can choose one of these two strategies: either imposing austerity on Italy via a continuous reduction of its fiscal deficits over a 3-year horizon independently of the needs and situation of Italy itself or instead allowing for new fiscal rules, not austere, which take for example the form of allowing for a golden rule (GR) on public investment whereby Italy could be judged in its fiscal stance without taking into account public expenditure on public investment and thereby converging indeed to a 3% deficit over GDP buto ne not comprising the latter spending, even if slightly costly politically for the EU. Notice that the former is what the EU Stability Pact requires today, while the latter is the current bargaining stance of the Italian government during its Ecofin talks in Brussels.

In such a game the actor called Italy confronting the actor Rest of the European Union can also choose one of these two strategies: either avoiding to reform its public sector spending characterized by waste (mostly because of incompetence and of some corruption) or adopting a spending review (SR) where the quality of public spending is reined under control, even if slightly costly politically. Notice that the former is the current situation in the peninsula while the latter is hardly expressed at all today in Italian political circles, even though one could claim that the EU would approve of it (albeit there is little evidence of a strong focus by the European Commission on this essential reform, SR).

Pay offs

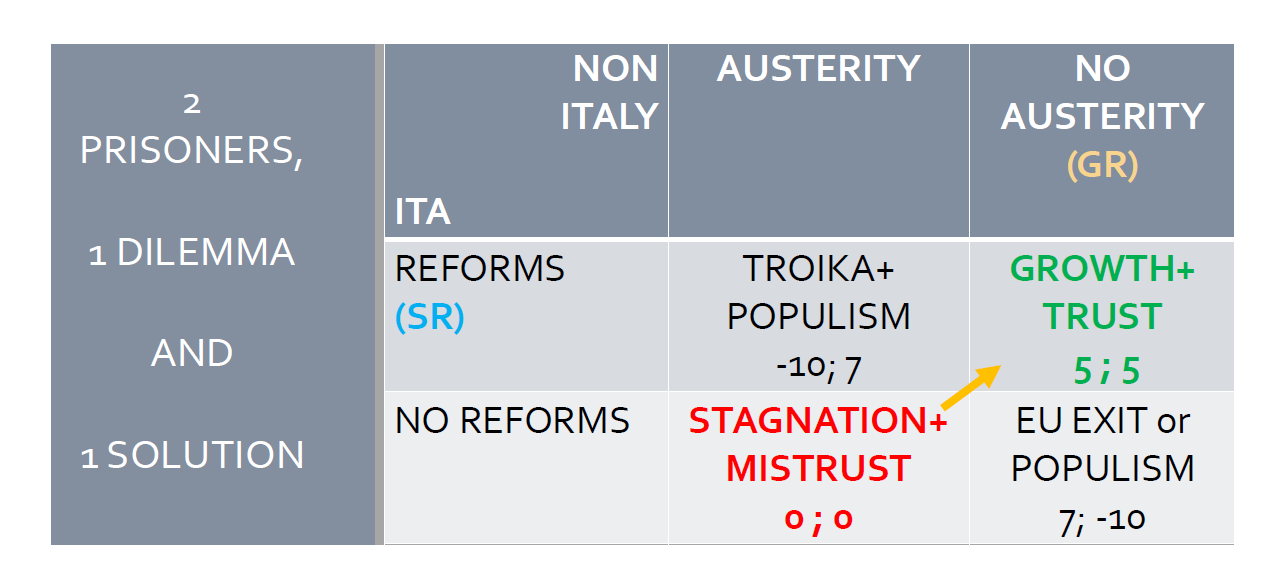

The above bi-matrix shows on the two last rows the strategies available to Italy and on its two last columns the strategies available to the Rest of the European Union. In each cell where numbers are posted, a combination of pay-offs is shown, the first number pertaining to the pay-offs of Italy, the second to the pay-offs of the rest of the European Union. For example, where one reads (-10; 7) minus 10 refers to the level of overall “happiness” of Italy,while plus 7 refers to the one of the Rest of Europe. – 10 is in this game a worse outcome for Italy and +7 the best for the Rest of Europe, individually speaking.

Notice the structure of pay-offs assumed: Italy would love to have no austerity imposed on it and not do the harsh reforms of its public sector through a spending review (maximum pay-off of +7 for Italy), capturing – if not a well-known fact – a feeling that is predominant in the Rest of Europe. In this case (south-east cell) we could even think that such an outcome would amount to a general EU exit, leaving Italy as the … only EU member remaining, given the inevitable populism against the European Union that would arise in all non-Italy member states electorates in the face of a laggard, lazy, (corrupt ?) country with no discipline that is given a free rein by the European Union (minimum pay-off of -10 for Europe).

Doing costly reforms and suffering austerity is on the other hand the worse outcome for the Italians, as it was for the Greeks (north-west cell). What about for the Rest of Europe? Well, their feelings are symmetric: their best (worse) outcome would be the nightmare (dream) of Italy. So the rest of the EU would much prefer austerity and reforms imposed on Italy rather than the opposite (no austerity and no reforms). We wish to call this situation in this cell as the one of a “Greek Troika”, leading to populism this time in Italy and to a possible euro exit on the part of the Italians.

Notice also that a cooperative compromise (north-east cell) – where Italy gets to obtain the golden rule GR with a lot more of public investment allowed (no austerity) but with the reform of the spending review SR implemented- is not the ideal outcome for each single actor involved in this game.

To be sure, let’s check the characteristics of this cooperative outcome: a situation where the Rest of Europe allows Italy to invest through the public sector with the guarantee that that spending is properly done. This is very different from the current situation, where the funds lent and transferred through the EU Recovery Plan by the EU to Italy are not spent or are badly spent for lack of administrative capacity. It is also very different on the side of EU stance, since today the same Recovery Plan attached conditionalities require Italy to strictly converge to a harsh and austere 3% deficit-GDP ratio within 3 years.

But how will this non cooperative game and interaction end?

Equilibrium

We know the answer from elementary game theory: the game will end in the (south-west) cell where both actors are going to be thoroughly disappointed, with Italy having to suffer austerity and the Rest of Europe abandoning the hope for Italian reforms, that it wished for. Reciprocal mistrust would be the political feature of this state of affairs.

Most of all, this equilibrium, our prisoner’s dilemma, has two interesting features: as a description of reality, it mimicks the current state of stagnation of Europe and Italy; while as a normative outcome it bears the features of a total lack of optimality, since both actors could be better off in the cooperative equilibrium, characterized by a golden rule for investment in Europes’ Stability Pact and a spending review reform in Italy, with the added positive consequence of a shift from a reciprocal mistrust to a credible and effective reciprocal trust. Moreover, a virtuous circle would arise as it would be likely that markets would eliminate any spread on Italian government bonds, freeing additional resources for growth and stability in terms of a lower Debt-GDP ratio in the peninsula.

So the key questions that remains to be solved is: how to shift from the current, disastrous, non cooperative equilibrium of stagnation and mistrust to a cooperative one where both players would sign on a compromise that would make them better off compared to today, allowing trust to materialize? That is the sense of the yellow arrow in the bimatrix. Well, leadership on both parts is likely to be the answer. If such trust exists at all today on both sides is an answer that is easy to give since we still remain in stagnation, but maybe one day…