So the Greek house is on fire.

What do you do if you are an insurer and the house you have insured is on fire? Do you start arguing about the bill or do you rush to save it, to help those who are at risk in the house while also helping to minimize your bill? (thank you A. for this good image).

Obvious answer: you save the house and the people in it. You’ll have time to discuss about who pays the repairs and, especially, how to make sure these things do not happen again. Because, somehow, you have a feeling things did not burn simply by random chance. Somebody has not taken the right precautions. And, guess what? You as an insurer feel a bit guilty. Because you have not checked properly that precautions were taken by a distracted home-owner and, frankly, you know too well that you yourself gained quite a lot in charging less to the home-owner and looking the other way while he was not fixing the house properly to protect it against fire. Isn’t it right Mr. Europe? Mr. Eurostat? Mr. European Commission? Mr. European Central Bank? Where were you exactly when the Greek house was being built on shaky grounds?

I can ask you these questions because, see, I hold shares of this insurance company. And I am a bit tired to see my costs go up and my dividends go down. I hired you guys to do the job as CEOs of this insurance company and it looks to me as if you should be fired. Not only you have not checked how the house was built by looking elsewhere, not only you have still not told me what went wrong (by the way, I am still waiting to know the details of that derivative transaction between Greece and Goldman Sachs), but now you are screaming at the guy whose house is burning to tell him to use “properly” that bucket of water while you look standing by, yelling “Fire, fire!”?

I say enough.

I say you do what I told you to do around last year and you said that it was too crazy to consider. Yes. That’s right. Take all the resources we have and stop once and forever the fire. The way I say it, not the way you said last year which proved WRONG. Not with more austerity which has made the Greek-debt over GDP ratio rise dramatically instead of going down. That was fuel in the fire, not water.

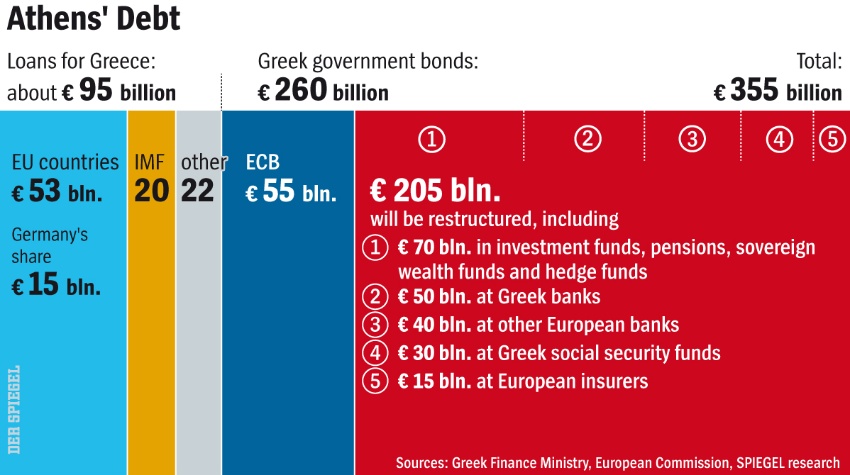

No. You cancel all of the 200 billion and more of the Greek public debt that is owed to non Greek citizens. Now. That will imply paying the bill ourselves, I know. But I prefer to take the loss now once and for ever and concentrate on future business without the looming threat of larger losses in the future. In terms of GDP, since our GDP is approximately 9000 bn. Euro, that would imply a lump-sum loss of 2.5% of GDP this year. Per capita, 700 euro per person.

Yes. Quite a lot. But now see this.

First of all, we allow Greece from now on to self-finance itself through its taxes. Actually, we could even allow for a ban on lending to Greece for 5 to 10 years. Nice prospect for the euro area, not to have to be judged in its cost of funding by a Greek crisis, ain’t it?

Second, we keep Greece in the euro. Can you imagine the impact on Greek citizens? Not only we reduced their large suffering for ever with a little suffering for one year for us, but we also have their full and complete gratitude. Now, isn’t this the safest and most credible loan a country can be owed? Gratitude! You can be sure that Greece will finally implement credibly so many meaningful economic reforms with enthusiasm!

And, third, imagine that, no fear of contagion. Yes, you might argue that markets could say “the cost of defaulting is going down, next is Italy and Spain”. No, it will not work like that. Markets are already pricing, with these huge spreads in the market, the disbelief at the stupidity of austere policies. They can’t wait for growth-oriented fiscal policies plus reforms, driven by Germany first of all.

Once the house will have been saved, it will be time to say “no more”, to the Greeks and everyone else. No more to accounting tricks in public accounts, no more benevolent approval of false accounts because of political reasons, no more lack of transparency regarding what is known but can’t be said because it would (unbelievable to hear, but he actually said it!) roil the markets.*

Stop the fire now, we want the euro and we want Europe, with its values and its geo-political ambitions that can only be fulfilled over the long-run if its values are upheld.

* (M. Trichet’s declaration as to why he will not release details of derivatives transactions of Greece: “The European Central Bank refused to disclose internal documents showing how Greece used derivatives to hide its government debt because of the “acute” risk of roiling (sic) markets, President Jean-Claude Trichet said.”(Bloomberg, November 5, 2010). “The information contained in the two documents would undermine the public confidence as regards the effective conduct of economic policy,” Trichet wrote in an Oct. 21 letter in which he rejected the appeal. Disclosure “bears, in the current very vulnerable market environment, the substantial and acute risk of adding to volatility and instability.”).